All Categories

Featured

Table of Contents

They normally give an amount of insurance coverage for a lot less than long-term types of life insurance. Like any type of policy, term life insurance policy has benefits and drawbacks relying on what will work best for you. The advantages of term life consist of price and the ability to tailor your term length and coverage amount based on your requirements.

Depending on the kind of policy, term life can offer fixed premiums for the entire term or life insurance policy on level terms. The fatality benefits can be taken care of.

Flexible What Is Level Term Life Insurance

Rates reflect plans in the Preferred And also Rate Course issues by American General 5 Stars My agent was really experienced and helpful in the process. July 13, 2023 5 Stars I was pleased that all my needs were met without delay and properly by all the agents I spoke to.

All documentation was electronically finished with access to downloading and install for personal documents upkeep. June 19, 2023 The endorsements/testimonials presented should not be interpreted as a recommendation to purchase, or a sign of the value of any type of service or product. The reviews are real Corebridge Direct consumers that are not connected with Corebridge Direct and were not offered settlement.

2 Cost of insurance policy prices are determined utilizing approaches that vary by firm. It's crucial to look at all variables when reviewing the general competitiveness of rates and the worth of life insurance coverage.

Flexible Guaranteed Issue Term Life Insurance

Nothing in these materials is planned to be suggestions for a particular circumstance or person. Please talk to your own advisors for such suggestions. Like many group insurance coverage plans, insurance coverage offered by MetLife include specific exclusions, exceptions, waiting durations, reductions, constraints and terms for maintaining them effective. Please contact your advantages administrator or MetLife for expenses and total information.

For the a lot of component, there are two kinds of life insurance policy plans - either term or irreversible plans or some mix of the 2. Life insurance firms supply different kinds of term plans and typical life policies as well as "rate of interest delicate" items which have come to be a lot more common because the 1980's.

Term insurance coverage supplies security for a specified time period. This period can be as short as one year or provide insurance coverage for a details variety of years such as 5, 10, twenty years or to a defined age such as 80 or sometimes up to the earliest age in the life insurance policy mortality.

Tailored What Is Level Term Life Insurance

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Currently term insurance rates are extremely affordable and among the cheapest traditionally skilled. It ought to be kept in mind that it is a commonly held belief that term insurance policy is the least costly pure life insurance policy coverage readily available. One needs to examine the policy terms very carefully to decide which term life options are suitable to meet your specific situations.

With each new term the costs is boosted. The right to restore the plan without proof of insurability is an essential advantage to you. Or else, the threat you take is that your wellness might degrade and you may be unable to acquire a plan at the very same prices and even whatsoever, leaving you and your recipients without protection.

The size of the conversion duration will vary depending on the kind of term policy bought. The premium rate you pay on conversion is generally based on your "current acquired age", which is your age on the conversion day.

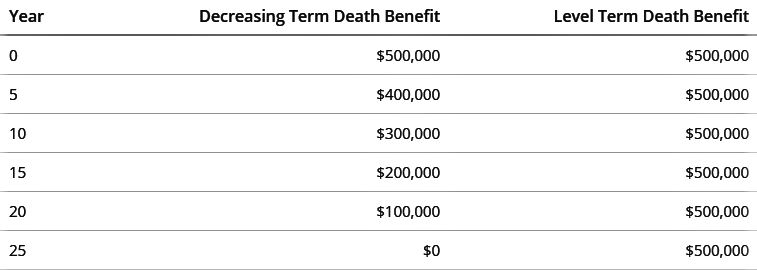

Under a degree term policy the face quantity of the plan remains the same for the entire period. Usually such policies are marketed as home mortgage protection with the quantity of insurance decreasing as the balance of the mortgage reduces.

Typically, insurance companies have not deserved to change costs after the plan is sold (level term life insurance). Given that such policies may continue for many years, insurers have to use traditional mortality, interest and expenditure price estimates in the premium estimation. Flexible costs insurance coverage, however, enables insurance firms to use insurance at reduced "current" costs based upon much less traditional presumptions with the right to change these costs in the future

High-Quality Joint Term Life Insurance

While term insurance policy is created to supply protection for a specified amount of time, permanent insurance is created to give protection for your whole life time. To maintain the premium price degree, the premium at the more youthful ages surpasses the actual price of protection. This extra premium constructs a book (cash worth) which assists pay for the plan in later years as the expense of security surges above the premium.

Under some policies, premiums are called for to be paid for a set number of years. Under various other policies, premiums are paid throughout the insurance holder's lifetime. The insurance policy business spends the excess costs bucks This type of policy, which is occasionally called money worth life insurance, produces a cost savings component. Cash money worths are crucial to a long-term life insurance coverage policy.

Family Protection Level Premium Term Life Insurance Policies

In some cases, there is no correlation in between the dimension of the cash money worth and the premiums paid. It is the cash value of the plan that can be accessed while the policyholder lives. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the present table made use of in determining minimum nonforfeiture values and plan gets for regular life insurance policy policies.

There are two standard categories of permanent insurance policy, standard and interest-sensitive, each with a number of variants. Traditional entire life policies are based upon long-term estimates of expense, interest and death (group term life insurance tax).

If these estimates change in later years, the business will change the costs appropriately yet never ever over the optimum ensured costs stated in the policy. An economatic whole life plan attends to a standard amount of getting involved entire life insurance policy with an additional supplementary protection offered via making use of returns.

Since the premiums are paid over a much shorter span of time, the premium repayments will be greater than under the whole life strategy. Solitary premium entire life is minimal repayment life where one huge premium settlement is made. The policy is fully paid up and no more costs are required.

Latest Posts

Funeral Policy For Over 80 Years

And Final Expenses

Funeral Plan Insurance Policies