All Categories

Featured

Table of Contents

If you select degree term life insurance coverage, you can budget for your premiums because they'll stay the same throughout your term. And also, you'll know precisely just how much of a fatality benefit your beneficiaries will receive if you pass away, as this amount will not transform either. The prices for level term life insurance policy will certainly depend upon a number of variables, like your age, health and wellness status, and the insurance provider you choose.

Once you experience the application and clinical exam, the life insurance policy business will assess your application. They ought to educate you of whether you have actually been approved shortly after you use. Upon approval, you can pay your initial costs and sign any appropriate documentation to ensure you're covered. From there, you'll pay your costs on a regular monthly or yearly basis.

Aflac's term life insurance coverage is convenient. You can choose a 10, 20, or three decades term and enjoy the added assurance you deserve. Working with an agent can help you discover a policy that works finest for your needs. Find out more and obtain a quote today!.

As you look for ways to secure your financial future, you've most likely encountered a wide array of life insurance policy choices. voluntary term life insurance. Picking the best insurance coverage is a big choice. You intend to find something that will certainly help support your enjoyed ones or the causes essential to you if something takes place to you

Numerous individuals lean toward term life insurance for its simplicity and cost-effectiveness. Term insurance contracts are for a relatively short, specified time period yet have choices you can customize to your requirements. Certain benefit choices can make your costs transform over time. Degree term insurance policy, however, is a kind of term life insurance policy that has consistent repayments and an imperishable.

Long-Term Group Term Life Insurance Tax

Degree term life insurance is a subset of It's called "degree" due to the fact that your premiums and the advantage to be paid to your enjoyed ones remain the exact same throughout the contract. You won't see any adjustments in expense or be left questioning its value. Some contracts, such as each year renewable term, may be structured with premiums that boost over time as the insured ages.

Dealt with fatality benefit. This is additionally established at the start, so you can know precisely what death advantage amount your can anticipate when you die, as long as you're covered and up-to-date on costs.

You agree to a fixed costs and fatality advantage for the period of the term. If you pass away while covered, your death benefit will certainly be paid out to liked ones (as long as your premiums are up to date).

You might have the choice to for one more term or, much more likely, restore it year to year. If your contract has actually a guaranteed renewability provision, you may not need to have a brand-new clinical exam to maintain your protection going. Your costs are likely to boost due to the fact that they'll be based on your age at revival time.

With this alternative, you can that will certainly last the remainder of your life. In this instance, again, you may not need to have any type of brand-new medical examinations, yet costs likely will climb as a result of your age and new coverage. direct term life insurance meaning. Different firms offer various options for conversion, be sure to recognize your choices prior to taking this action

Cost-Effective Term Vs Universal Life Insurance

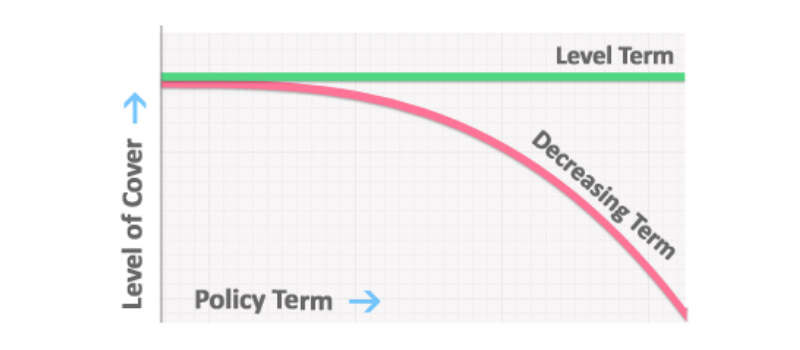

The majority of term life insurance coverage is level term for the duration of the contract duration, yet not all. With lowering term life insurance coverage, your death benefit goes down over time (this kind is frequently taken out to particularly cover a long-lasting financial obligation you're paying off).

And if you're established up for eco-friendly term life, then your premium likely will increase yearly. If you're exploring term life insurance policy and wish to make sure straightforward and foreseeable economic security for your family, degree term may be something to think about. As with any kind of type of insurance coverage, it may have some limitations that do not fulfill your requirements.

Leading Level Premium Term Life Insurance Policies

Usually, term life insurance is much more budget-friendly than irreversible insurance coverage, so it's a cost-efficient method to safeguard monetary protection. Adaptability. At the end of your agreement's term, you have several choices to proceed or go on from insurance coverage, often without needing a clinical examination. If your budget or coverage requires modification, survivor benefit can be minimized over time and cause a reduced costs.

Similar to other kinds of term life insurance coverage, when the contract ends, you'll likely pay higher costs for coverage because it will recalculate at your present age and wellness. Repaired insurance coverage. Degree term provides predictability. If your monetary situation modifications, you may not have the essential insurance coverage and might have to purchase added insurance.

Yet that doesn't suggest it's a fit for every person. As you're shopping for life insurance coverage, right here are a couple of vital aspects to think about: Budget. Among the benefits of degree term insurance coverage is you recognize the cost and the death benefit upfront, making it simpler to without stressing concerning boosts in time.

Age and wellness. Generally, with life insurance policy, the much healthier and younger you are, the more budget-friendly the insurance coverage. If you're young and healthy, it may be an attractive alternative to secure reduced costs now. Financial obligation. Your dependents and financial obligation play a duty in establishing your protection. If you have a young family members, as an example, degree term can help provide financial support during critical years without spending for coverage much longer than needed.

1 All motorcyclists are subject to the terms and conditions of the cyclist. All motorcyclists might not be available in all territories. Some states might differ the terms (group term life insurance tax). There might be a service charge connected with obtaining specific riders. Some motorcyclists may not be readily available in mix with various other riders and/or policy features.

2 A conversion credit rating is not readily available for TermOne policies. 3 See Term Conversions area of the Term Collection 160 Item Overview for exactly how the term conversion credit score is identified. A conversion credit report is not readily available if premiums or fees for the new policy will be waived under the regards to a motorcyclist offering impairment waiver benefits.

High-Quality Guaranteed Issue Term Life Insurance

Policies transformed within the very first policy year will get a prorated conversion credit report subject to conditions of the policy. 4 After five years, we reserve the right to limit the long-term item used. Term Series products are issued by Equitable Financial Life Insurance Policy Business (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Company of The Golden State, LLC in CA; Equitable Network Insurance Coverage Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance policy is a kind of life insurance policy plan that covers the insurance policy holder for a certain amount of time, which is referred to as the term. The term lengths vary according to what the private picks. Terms typically range from 10 to 30 years and increase in 5-year increments, offering degree term insurance policy.

Latest Posts

Funeral Policy For Over 80 Years

And Final Expenses

Funeral Plan Insurance Policies